Become the Bank By Being a Private Lender!

You can earn double digit returns by becoming THE bank. It’s easier than you think and it’s called Private Lending.

Take advantage of the opportunity to become the bank and earn double digit returns with an investment that is backed by physical real estate as collateral. Investing passively in Real Estate means never having to deal with tenants, toilets or termites.

What is Private Money Lending

You Ask?

Private Lending is when regular people like you and me lend money to a proven real estate investor to buy distressed properties at a discount.

The funds to close on the purchase and make renovations are secured and protected by a promissory note and mortgage against the property that you approve for your investment. It’s your opportunity to grow your wealth with a fixed return and time period.

Less Dependence on the Stock Market is Freeing!

Less Dependence on the Stock Market is Freeing!

We know you want peace of mind when it comes to your investments and your financial future. However, with stock market volatility, you are often on a rollercoaster without much control over where and how your money is invested.

You deserve to enjoy the life and rewards that come along with diligently investing your hard earned money. That’s why we created Velocity Properties. As a Private Lender, you choose the projects in which to invest, and you design the structure and terms of your investment.

Whether you’re brand new to private lending or a seasoned investor looking for a skilled real estate redeveloper, you’re in the right place!

How To Be A Private Money Lender

Find the Deal

We identify the property to acquire that fits our buying and profit criteria.

Decide To Lend

You review the easy to understand financial analysis of the deal.

Renovate It

We complete the renovation and refinance the property.

Get Paid

Once the project is completed you’ll receive your money back with interest.

What is Co-Living?

What is Co-Living?

Co-living is a modern form of communal housing where unrelated individuals share a property including a private living space such as a bedroom, along with communal areas like kitchens, bathrooms, and common areas. Co-living is a true win/win because not only does it directly help address the housing crisis by providing clean, safe, and affordable housing, but it helps build a sense of community and social connection among residents, while providing investors with returns 3x higher than traditional long-term investment strategies.

The 4 “F’s” of Co-Living

We have significant experience with co-living, having owned and managed 3 properties with 22 bedrooms over the last 4 years. Here are the general steps we utilize to build our co-living business. We call it “the 4 Fs!”

1. Find:

We generally look for properties that are less desirable to the average

residential homebuyer. Examples include a property on a busy street,

backs up to commercial property, or has a very choppy floor plan that

home buyers may not want. Other key attributes of an ideal co-living

property include:

- No HOA

- Large floor plan with space that can be converted to bedrooms, like

dining rooms, living rooms, or bonus rooms

- Lots of parking, either street parking or off-street parking

- Located in cities or counties that do not heavily regulate the number of unrelated people allowed in one household

- Locations where neighbors are not likely to complain to the city or

county

2. Fund:

We generally buy distressed properties that need renovation by using a hard money loan and/or investment partners. After we complete renovations and fully rent the property, we use the 3-6 months of rent payments as documentation for the lender to refinance the property into a long-term loan.

3. Fix:

Designing the property for co-living upfront is the key to successfully managing a co-living property! There are key design decisions and renovations that need to be implemented. Some examples include:

- Converting low-value space to bedrooms, including dining rooms, living rooms, bonus rooms, etc.

- We leave a small amount of shared space including an eating area, outside decks, and/or patios for members to enjoy.

- We add as many bathrooms as possible with the goal of approaching a 1:1 bedrooms to bathrooms ratio.

- We provide several refrigerators, designated pantry space for each person, high speed internet, Ring security cameras outside, and digital door locks on all doors including external doors and bedroom doors.

- We do not install TVs or in the common space.

3. Fix:

Designing the property for co-living upfront is the key to successfully managing a co-living property! There are key design decisions and renovations that need to be implemented. Some examples include:

- Converting low-value space to bedrooms, including dining rooms, living rooms, bonus rooms, etc.

- We leave a small amount of shared space including an eating area, outside decks, and/or patios for members to enjoy.

- We add as many bathrooms as possible with the goal of approaching a 1:1 bedrooms to bathrooms ratio.

- We provide several refrigerators, designated pantry space for each person, high speed internet, Ring security cameras outside, and digital door locks on all doors including external doors and bedroom doors.

- We do not install TVs or in the common space.

4. Fill:

The most important component of managing a successful

co-living property is choosing the right members to live there. If you have the right members in the property, things operate beautifully! On the other hand, the wrong members could jeopardize the entire model! Here are the keys to filling the property with great members, and keeping them long-term:

- Potential members must have a credit score of 630 or higher, earn at least 3x the rent amount in documented income, have no criminal record, and provide rental references for the last 3 years.

- We use month-to-month agreements or membership agreements to facilitate the speedy removal of problem members.

- We use a list of 25 “house rules” that all members must read and sign. These rules include things like no weapons, no drugs, limits to overnight guests, rules around personal items in common areas, chore schedules, etc.

- We provide a housecleaner who comes monthly to clean all of the common areas and bathrooms.

- We provide high speed internet to the property.

- All utilities and landscaping costs are built into the rent.

4. Fill:

The most important component of managing a

successful co-living property is choosing the right members to live there. If you have the right members in the property, things operate beautifully! On the other hand, the wrong members could jeopardize the entire model! Here are the keys to filling the property with great members, and keeping them long-term:

- Potential members must have a credit score of 630 or higher, earn at least 3x the rent amount in documented income, have no criminal record, and provide rental references for the last 3 years.

- We use month-to-month agreements or membership agreements to facilitate the speedy removal of problem members.

- We use a list of 25 “house rules” that all members must read and sign. These rules include things like no weapons, no drugs, limits to overnight guests, rules around personal items in common areas, chore schedules, etc.

- We provide a housecleaner who comes monthly to clean all of the common areas and bathrooms.

- We provide high speed internet to the property.

- All utilities and landscaping costs are built into the rent.

How We Do It

Co-Living addresses housing affordability and drives more income for property owners from unused space.

1. Find

Identify unique potential co-living properties that are undesirable to most residential home-buyers where bedrooms can be maximized.

2. Fund

Purchase property with hard money and/or investment partners, renovate, and then refinance.

3. Fix

Convert low-value space to bedrooms including dining, living, and bonus rooms. Add multiple bathrooms and pantry space.

4. Fill

Screen potential members very carefully, review house rules, and use short-term leases or membership agreements.

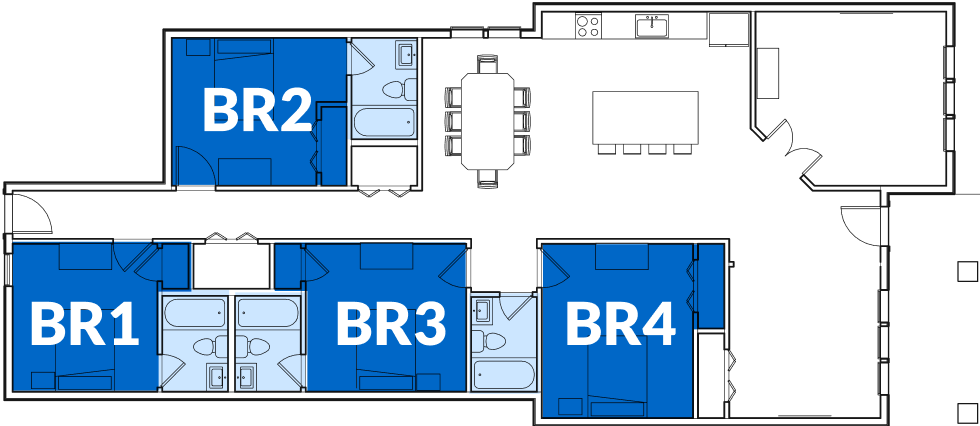

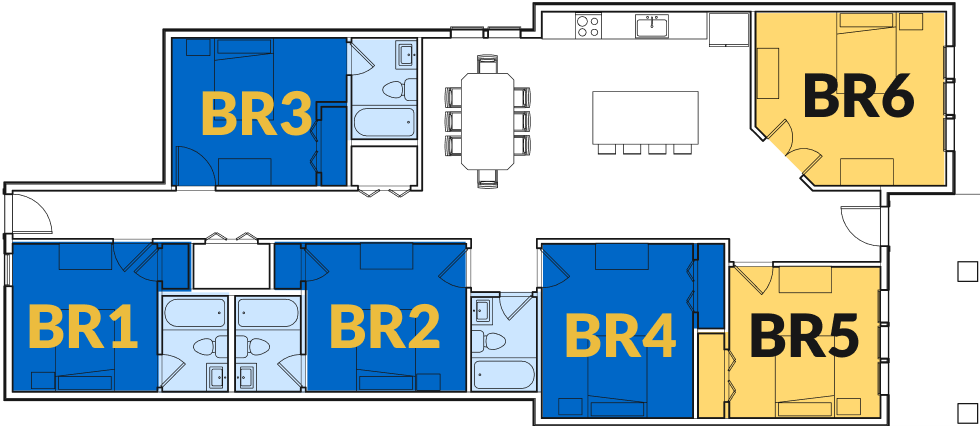

Before Co-Living

After Co-Living

After Co-Living

$2,400/mo rent

Tenants

$775/mo/bedroom all inclusive

$1,702 net income

Landlords

$3,458 net income

Partner With Us!

We have two partnership opportunities for those interested in co-living. If you are someone interested in beginning a co-living journey but needs guidance, we offer 1 on 1 coaching for you every step of the way. Or if you are interested in partnering with us on buying a co-living property to hold long-term, we regularly have deals available to partner with people.

Use the links below to schedule a meeting with Eric to discuss how we can help you meet your goals.

We look forward to it!

Partner With Us!

We have two partnership opportunities for those interested in co-living. If you are someone interested in beginning a co-living journey but needs guidance, we offer 1 on 1 coaching for you every step of the way. Or if you are interested in partnering with us on buying a co-living property to hold long-term, we regularly have deals available to partner with people.

Use the links below to schedule a meeting with Eric to discuss how we can help you meet your goals.

We look forward to it!

Who We Are

Meet Eric & Valerie Tate

We are a real estate investment company that specializes in buying, fixing and renting single family homes, multifamily homes and apartments. We partner with private lenders to fund the acquisition and renovation of the properties while providing excellent returns.

Eric Tate

CEO

Eric Tate is a full-time Real Estate Investor and former Sr. Director at Blue Shield of California. After 31 years in corporate America working for other people, Eric was ready to work for himself. Although he was a highly recognized senior leader and Chief of Staff in his corporate role, he decided that a traditional education with an MBA in Finance combined with the false security of a 9-5 job was not producing the results he wanted.

Real estate investing was the game changer.

With 16 years of successful real estate investing experience, Eric resigned from his corporate job in 2022 to pursue his passion in real estate full time. Eric develops creative rapport and trust building strategies that has allowed him to raise over $5.3 million in private money used to help complete 31 renovation projects in the last 4 years, including 13 houses flipped and 51 multi-family rental units owned and self-managed.

When he’s not managing renovation projects, Eric enjoys traveling with his wife and business partner Valerie. He is also a dedicated father of five. Eric even spent 6 years coaching his son’s football team. He also enjoys playing golf with his sons and teaching financial education to his kids as they transition to adulthood.

Valerie Tate

CFO

Valerie Tate

CFO

Valerie Tate is a Real Estate Investor and Director of Performance Optimization at a leading California health care provider. She is also CFO and Co-founder of Velocity-Properties with her husband, Eric. With her 28 years of corporate experience, she keeps their investment projects on budget and on schedule.

Valerie is also the interior designer on all the renovation projects. Her great tastes ensure the properties are on trend with what buyers and tenants are looking for in their home. She also ensures the projects are profitable for investing partners.

Valerie continues in her corporate role while she and Eric build their real estate business. She is also a supermom of five children and two fur babies, and enjoys travel, music, and adventure. Valerie particularly likes to travel to Europe and has become an expert travel planner for her family!

Valerie Tate

CFO

Testimonials

Chad Morrison

I have known Eric and Valerie for many years and I jumped at the chance to become a private investor in their real estate venture. Having so many projects under their belt has clearly created a deep understanding of real estate and financial best practices to make investing as easy and streamlined as possible. Thank you both for this lucrative investment opportunity, I am looking forward to investing in your next project.

Maribel Cisneros

Eric and Valerie walked me through their project plans, the financials, estimated profits, and timeline. They were very professional and provided excellent regular updates on the project which gave me great confidence. They completed it on time and I earned double-digit returns on my investment. I highly recommend working with Eric and Valerie and I will definitely work with them on future projects!

Jennifer Mahrt

After meeting Eric and Valerie in their successful careers in the corporate world, I began watching their real estate investment journey and decided that I wanted to join in! I became a private lender for one of their fix and flip projects and was very impressed with their level of knowledge, expertise, and professionalism. I also enjoyed earning great returns on an investment in a protected, secured, and insured asset.

Examples of Our Work

This is a renovation project we completed in five months in El Dorado Hills, California with a 12% annual return to our private lenders.

Before

After

Before

After

Before

After

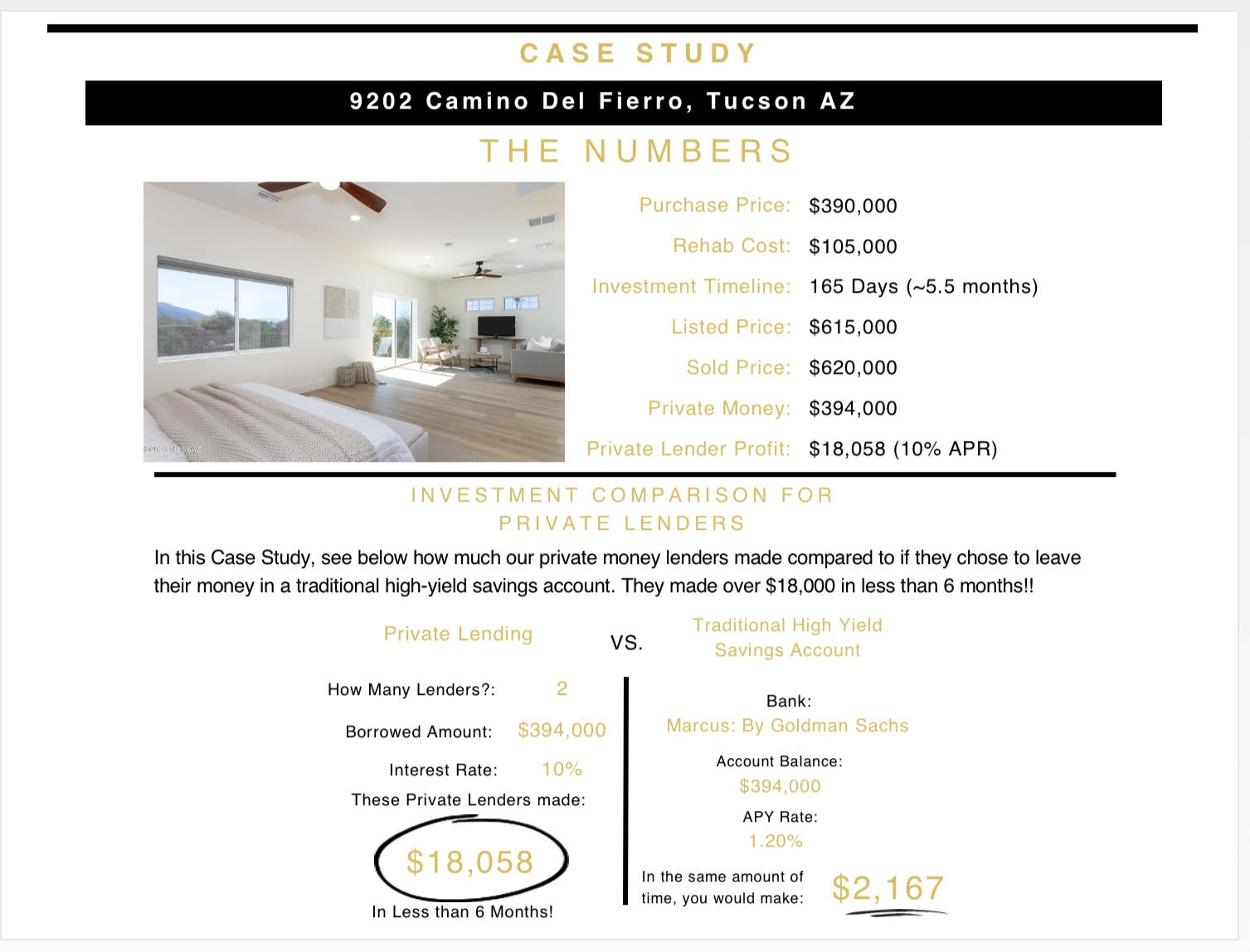

Here is a detailed case study of a renovation we completed in Tuscon, AZ.

FAQs

Why should you invest with us?

We have a proven track record of helping our Private Lenders earn double-digit returns on their short term investments. Private lending is one of the simplest forms of investing and can be an effective way to create a consistent and passive income stream.

What is private lending?

Private lending is when an individual makes the decision to lend their liquid capital into a real estate investment transaction with the expectation of earning returns on their money secured by collateral. Lenders can earn high-interest rates generally 4 or 5 times the rate you can get on bank CDs and other Traditional Investment Plans.

How is the money used?

On a property purchase requiring renovations, the cost will be allocated to the purchase price, renovations, carrying costs, cost to resell, and also a small buffer for unexpected expenses.

Why aren’t you using a Traditional Loan?

There are many reasons, but the primary reason is the time and speed of the transaction. Many of the homes we purchase are in need of a quick sale within 14-30 days. A traditional bank requires 30-45 days to close a loan. The leveraging power is far greater when we purchase using cash instead of financing. Many traditional home sales fall out of the contract because of financing issues, and this allows us to negotiate a lower purchase price and reduce our risk. Lending guidelines are also continually changing and are becoming increasingly more difficult.

How can you afford to pay 8% – 12% returns?

We make our money on the purchase, and this allows us to purchase 20%-30% below a retail consumer. This instantly creates equity in the transaction. Ideally, there is no middleman in a transaction, no commissions, mortgage broker fees, etc.

What Interest rate do you usually pay your private lenders?

Most of our lenders are paid 8%-12%. Our rates will fluctuate depending on the project and investment amount.

What if the market declines and values go down?

Our strategy is one that allows us to get in and out of the transaction quickly. We also build in a 10%-25% buffer on deals to ensure we do have a safety net if the market does quickly shift. Most projects are completed in 3-6 months and will be sold in 6-8 months. It’s important to note that we’re buying strategically where inventory is already low and demand is high; which overall minimizes risk.

What is the typical investment amount and term?

Our standard investment is a minimum of $100,000, but we’ve worked with investors who wanted to invest as little as $50,000. Typical loan timeframe is 6 to 24 months. We will review all of the details of the project with you beforehand so that you know exactly what the expectations are and the timeline for all parties involved.

When will I receive a payment?

Our standard practice is to pay one large lump sum at closing on a short-term note. This is much easier to manage for all involved, especially if we’re pulling funds from a retirement account. Monthly interest payments are possible but not standard practice.

Is there a guarantee on my investment?

No. There is no government-backed guarantee on these privately held real estate notes. Your protection is from the equity within the real estate being held. If at any time we were to default, you have the legal right to take the home and foreclose on the transaction. It’s important to note that we build a solid plan and strategy in place for the “worse case scenarios”. Because our properties usually have tens of thousands of dollars of equity when purchasing, your investment is well protected.

What are the possible sources of funds I could use to invest?

There are many sources of funds you can use. You can use cash that might be sitting in a savings account, a Home Equity Line of Credit (HELOC), or even use your retirement account. Many people are not aware that in many cases, the IRS allows you to transfer your existing IRA to a Self-Directed IRA. Once in a Self-Directed IRA, you can invest in a wide variety of investments. And if it is a Roth IRA, your investment can grow tax-free! Consult your professional tax advisor for more details.

What type of insurance policy do you usually obtain and who buys it?

We provide insurance on all purchased properties. We pay for a title search prior to closing and also provide a title policy on the property, just as we would in a typical transaction. If we purchase a property that requires renovation, we utilize a Builder’s Risk insurance policy. In the event of any damage, insurance distributions would be used to rebuild or repair the property, or used to pay you back.

How much will it cost to lend to you?

It is our policy to pay for all closing costs so that your investment goes to work for you within the project. We do not charge any fees or commissions to our private lenders.

Will my money be pooled with other investors?

No, we do not pool funds. Your funding will be tied to one piece of property secured by a deed of trust.

How often will I receive updates?

You will receive updates atleast monthly with photos and the next steps on your investment.

Why Should You Partner with Us

You’ll get fantastic risk-adjusted returns which are perfect for self-directed accounts and idle cash earning you little interest. Private lending and Co-Living investments create a consistent, truly passive income stream for you and your family.